M3M Jewel Crest Avenue: The ROI Hotspot

Table of Contents

- 1. Location & Connectivity: Why Sector 97, Noida Expressway?

- 2. Investment Benefits & ROI Options for M3M Jewel Crest Avenue

- 2.1. 1. Higher Rental Yield in Commercial Retail vs Residential

- 2.2. 2. Capital Appreciation Potential

- 2.3. 3. Strong Brand / Developer Credibility

- 2.4. 4. Structural Product Advantages for Retail

- 2.5. 5. Diversification & Portfolio Strategy

- 2.6. 6. Futureproofing via Connectivity & Infrastructure Growth

- 3. Rental Yield & ROI: What to Expect for M3M Jewel Crest Avenue

- 4. Investment Benefits & ROI Options Summary

- 5. Conclusion

- 6. FAQs:

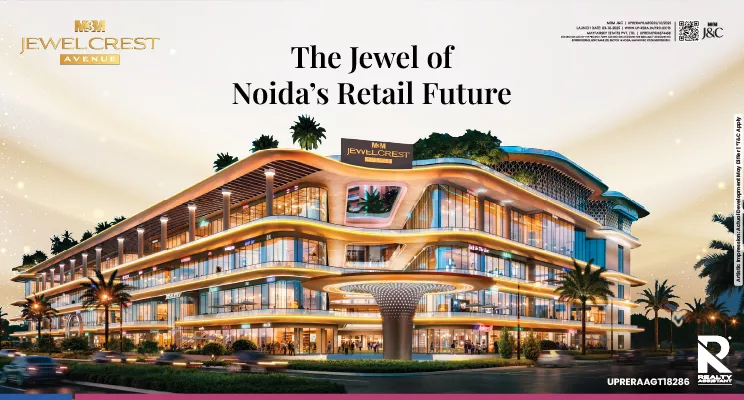

Located along the premium Noida–Greater Noida Expressway in Sector 97, Noida, M3M Jewel Crest Avenue is a newly launched commercial development from M3M India Pvt. Ltd. in collaboration with iconic luxury brand Jacob & Co. The project features ultra-luxury high-street retail shops, double-height façade units, open-sky plazas and premium pedestrian walkways. It is RERA-registered under UPRERAPRJ690055/10/2025. The offered carpet area ranges from approximately 3.16 sq m (~34 sq ft) to 172.17 sq m (~1,853 sq ft).

Key details at a glance:

- Project Name: M3M Jewel Crest Avenue (also marketed as “M3M J and C” on RERA).

- Developer: M3M India Pvt. Ltd. in association with Jacob & Co.

- Location: Sector 97, Noida (along Noida Expressway).

- Type: High-Street Retail / Shop units – “Retail Shops in M3M Jewel Crest Avenue”.

- Launch Date: August 2025 (New Launch).

- Possession Estimated: July 2030.

- M3M Jewel Crest Avenue RERA Registration: UPRERAPRJ690055/10/2025.

- Carpet Area: 3.16 sq m – 172.17 sq m (34 – 1,853 sq ft approx).

With this context, let’s explore the rental yield & ROI potential, the investment benefits, and the location & connectivity advantage of this project.

Location & Connectivity: Why Sector 97, Noida Expressway?

- Sector 97 is positioned along the Noida–Greater Noida Expressway, offering seamless access to Delhi, Greater Noida, and other NCR hubs.

- Connectivity to the upcoming Jewar International Airport ensures long-term strategic relevance of the corridor.

- Proximity to key hubs: golf courses, markets, metro stations and business zones. The developer’s brochure claims 10 min to Noida Golf Course, 12 min to Okhla Bird Sanctuary Metro Station, and Jewar Airport connectivity is just 35 min (once functional).

- The expressway corridor is emerging as a commercial-retail hub, with rising demand from high income clientele, expat professionals and luxury brands.

- Given this, M3M Jewel Crest Avenue is well placed to capture visibility, footfall, and long-term value appreciation.

Why this matters for retail investment:

Retail shops thrive on visibility, accessibility and a catchment of high-spending consumers. The location along the expressway ensures:

- High vehicular traffic and easy ingress/egress for visitors.

- A growing residential ecosystem nearby – affluent localities, premium residences are being developed in sectors along the expressway.

- Future infrastructure impetus (metro extensions, airport, road upgrades) which tend to drive value uplift in commercial properties.

Thus, for investors seeking commercial / retail shop exposure, this location ticks multiple boxes.

Investment Benefits & ROI Options for M3M Jewel Crest Avenue

1. Higher Rental Yield in Commercial Retail vs Residential

- In the broader Noida region, commercial properties typically yield 8-12% per annum of investment, compared to residential yields of ~3-4%.

- A recent insight mentioned that for Noida commercial investments, rental yields of 8-12% and potential capital appreciation 15-20% annually are realistic in prime corridors.

- For the expressway corridor specifically: commercial yields may fall in the higher bracket of this range given enhanced connectivity and visibility.

2. Capital Appreciation Potential

- The Noida Expressway corridor (sectors 93-150) has witnessed property price increases of 45-60% over five years for residential space; commercials have similar or higher upside given the demand for retail-commercial space.

- With the upcoming airport, metro expansion, and enhanced business hubs, the corridor is expected to benefit from structural growth.

- Hence, an investment in a premium retail project like this stands to gain both rental and capital upside.

3. Strong Brand / Developer Credibility

- M3M is a reputable builder in NCR with a number of landmark projects in their portfolio. At the same time, the association with Jacob & Co brings a luxury brand halo to the company.

- The credibility of the developer lowers the risk of execution and delivery, which is the main factor for commercial investments since the yield is dependent on factors such as occupancy, maintenance, and brand quality.

4. Structural Product Advantages for Retail

- The double-height shop facades, open-sky plazas, and landscaped pedestrian areas come together to create a modern high-street retail experience that is not only attractive to customers but also to brands, food and beverage outlets, and flagship stores.

- More visibility equals the ability to charge higher rents and better resale value.

- The M3M Jewel Crest Avenue Retail Shops for sale will let the owners enjoy both the benefits of receiving rental income and appreciating value in the long run.

5. Diversification & Portfolio Strategy

- The investment in high-street retail would be more diversified than the investment in residential real estate only.

- Retail shops can be considered passive income assets through their lease structures, while also giving the capital growth route as providing an inflation hedge.

6. Futureproofing via Connectivity & Infrastructure Growth

- Developments near expressways and major infrastructure (airport, metro) connections are usually more resilient and less to be considered outdated in the future.

- This translates to a lower risk of obsolescence and a greater chance of maintaining rental income and appreciation.

Rental Yield & ROI: What to Expect for M3M Jewel Crest Avenue

The trends can be used to come up with a projection of the returns that the investor may expect from M3M Jewel Crest Avenue Sector 97 Noida.

Let us take a hypothetical case:

- Say a retail shop of approximately 1,000 sq ft (≈93 sq m) carpet area is considered (the figure is just for illustration purpose).

- Let the purchase price (which already includes all charges) be ₹ X (the amount depends on the final pricing that you need to check).

- At say rental yield of 8-10% per annum (aligned to prime commercial norms), you could expect annual rental income of ~₹ 0.08X to 0.10X.

- Over 5 years, if capital appreciation is say 15% p.a. (conservative for such corridors), capital value may grow ~2x in that time.

- Hence combined yield + appreciation may result in compelling IRR (internal rate of return) for the investor.

Key variables to watch:

- Final price per sq ft / sq m — affects yield percentage.

- Lease terms, tenant quality and occupancy — retail yields are more tenant- and footfall-driven.

- Maintenance and strata/common charges — retail assets may have higher operating cost.

- M3M Jewel Crest Avenue Construction Update- Construction completion, possession date (July 2030 for this project) and ability of developer to deliver as promised. Before possession/lease starts you may incur costs without rental income.

- Market competition, alternative supply in nearby sectors, retail trends (e-commerce impact, F&B etc).

Given all this, for a well-located project like M3M Jewel Crest Avenue, achieving rental yield of 8-12% and capital appreciation of 12-20% p.a. over medium-term appears realistic — provided all variables align.

Investment Benefits & ROI Options Summary

Benefit | How It Works | Typical ROI/Observation |

High rental yield | Retail in prime corridor may yield 8-12% p.a. | Based on Noida market averages for commercial. |

Capital appreciation | Property values in expressway corridor rising 45-60% over 5 years (residential) — commercials may parallel or exceed. | Potential 12-20% p.a. appreciation |

Premium branding & design | Attracts better tenants, higher rents, lower vacancy risk | Qualitative benefit |

Large residential catchment & connectivity | Means footfall and demand for retail increases over time | Location advantage |

Developer credibility | Less execution risk, higher confidence for investor | Risk mitigation |

Diversified investment & inflation hedge | Retail assets less correlation with residential market | Portfolio benefit |

Conclusion

The M3M Jacob & Co Jewel Crest Avenue Noida is a tempting offer if you are seeking a commercial investment in a top-notch retail area of Noida. It has a firm developer/brand partnership (M3M plus Jacob & Co), a great site on the Noida Expressway, a high-end retail product, and supportive market basics (greater returns plus strong value increase potential), which makes it prominent among other commercial investments.

Of course, as with all investments, due diligence is crucial: ensure you have clarity on pricing, delivery schedule, unit size & façade, lease/tenant potential, maintenance costs and broader market trends. But given the data (e.g., Noida commercial yields 8-12% per annum) and the growing connectivity/infrastructure, this project presents an opportunity for investors seeking both rental income and capital growth.

FAQs:

Q. What about capital appreciation potential?

A. Given infrastructure tailwinds in the Noida Expressway corridor, capital appreciation of 12-20% per annum (or 45-60% over five years) is plausible in strong projects.

Q. What makes Sector 97 and Noida Expressway a good investment zone?

A. The corridor offers excellent connectivity (Expressway, future airport, metro), plus growing residential and commercial demand — which drives retail visibility, footfall and value.

Q. Are there any advantages to investing in retail vs residential property here?

A. Yes — retail/commercial property typically offers higher rental yield and appreciation potential than residential (which may give 3-4% yield in Noida).

Q. What should I check before buying a shop unit?

A. Key checks include: final pricing and payment plan, front-and-facing unit (visibility), parking & access, tenant mix (future-proof retail), RERA registration, delivery timeline/possession, maintenance/strata costs.

Q. What is the M3M Jewel Crest Avenue booking process?

A. Since this is a new launch by M3M India, you can contact us for M3M Jewel Crest Avenue for unit availability, booking amount, payment plan and contact number (usually indicated on the project website/marketing collateral).

Comments